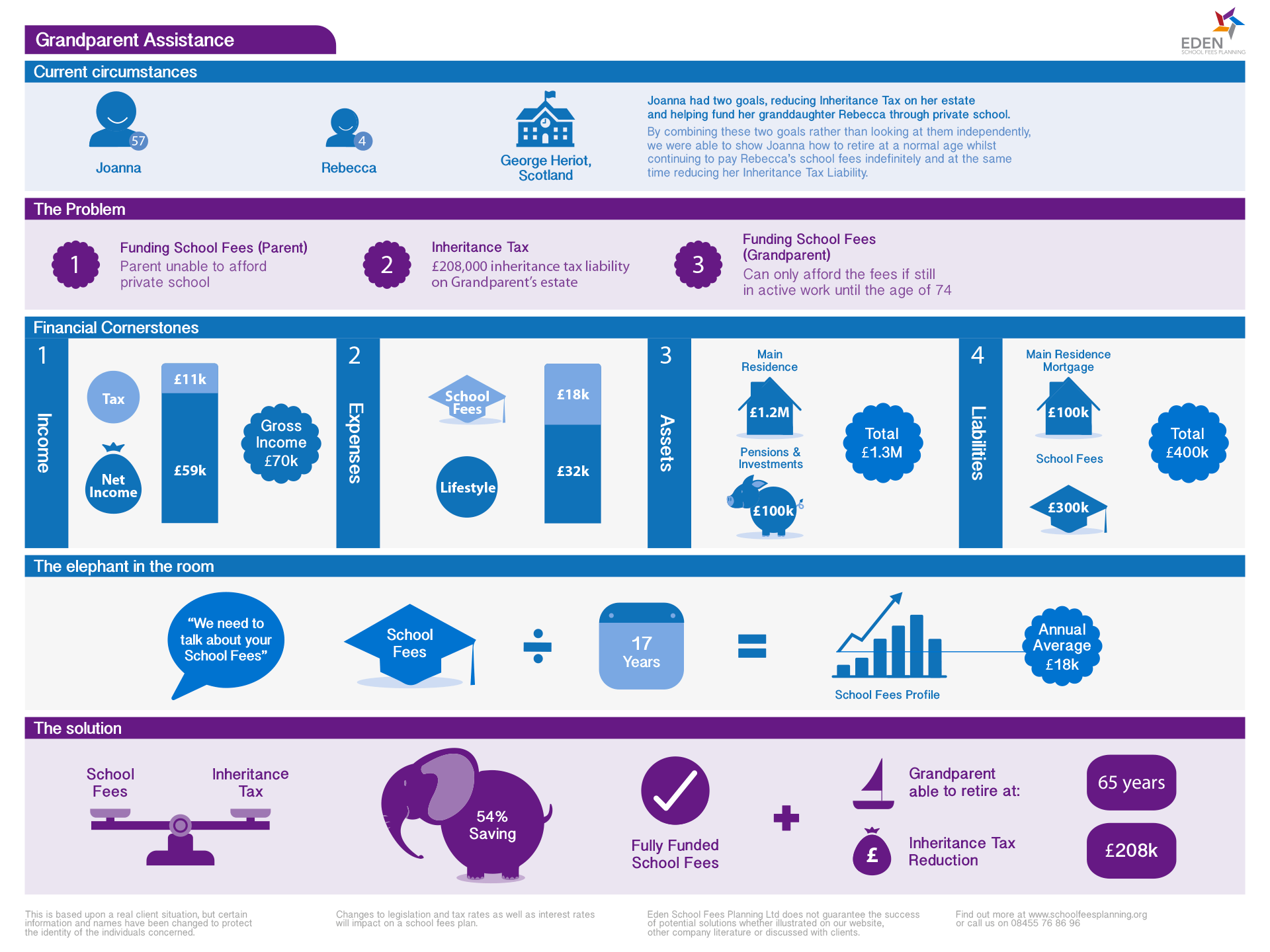

How we helped Joanna

Financial Cornerstones

Basic Assessment

Joanna’s daughter was struggling to pay for private school so Joanna had agreed to take over the payments.

Joanna came to us because she was concerned about the consequences to her own retirement, and IHT.

Problem and Implications

The main issues were as follows:

Joanna had her own business and was comfortable. The additional expense of Rebecca’s school fees was not an issue.

However, funding school fees from income was going to severely compromise Joanna’s lifestyle aspirations and potential for early retirement. Neither was she addressing her IHT issue.

Joanna’s main problem was purely a parent’s dilemma; help her daughter out and push back her own retirement, or enjoy an early retirement and let her daughter struggle.

This could lead to Rebecca having to leave private education only then for Joanna to then leave Rebecca and her mother a sizeable estate beyond after the point when they really needed it.

Killing THREE birds with one stone and two pebbles!

We were able allay Joanna’s fears and untangle her dilemma quite quickly.

Mortgage / Lifetime Mortgage

As Joanna wanted to avoid selling her home we considered how a mortgage could buy her time.

We highlighted how using capital instead of income to cover school fees would allow Joanna to enjoy her lifestyle and look to an earlier retirement whilst at the same time reducing IHT by creating a debt on her estate.

We then showed Joanna how, once retired she could switch from a traditional mortgage to a Lifetime Mortgage, giving her further flexibility and security but crucially meaning she could retire when she chose without sacrificing Rebecca’s school fees.

Lump Sum Investment

If Joanna were to increase her mortgage she would gain access to a lump sum of capital which she could invest.

We calculated the lump sum amount she would need to cover her school fees.

Other IHT Measures

Tax Efficient Investment

Creating a mortgage debt would not itself address the IHT issue as it also created a lump sum of capital.

Joanna’s school fees payments would help reduce IHT by eating away at the capital but it would take a long time. her IHT on the other hand was already alive and kicking.

We discussed with Joanna the existence of certain investments which sit outside of an estate for IHT purposes and how they could reduce the tax payable on her death.

IHT Insurance

A final option we worked through with Joanna was using insurance to mitigate her IHT liability.

Again, using her mortgage lump sum, she was able to fund an insurance premium which would pay out when she died.

Wrapping the policy in a suitable Trust, the proceeds would not form part of Joanna’s estate but could be used by her daughter to pay any remaining IHT liability not already covered.

Benefits

Joanna was overjoyed when we helped ease the weight of her dilemma. The key benefits were life changing.