How to save on School Fees!

Want to see how much you can save?

Talk to one of our experts about how we can help!

See what's possible

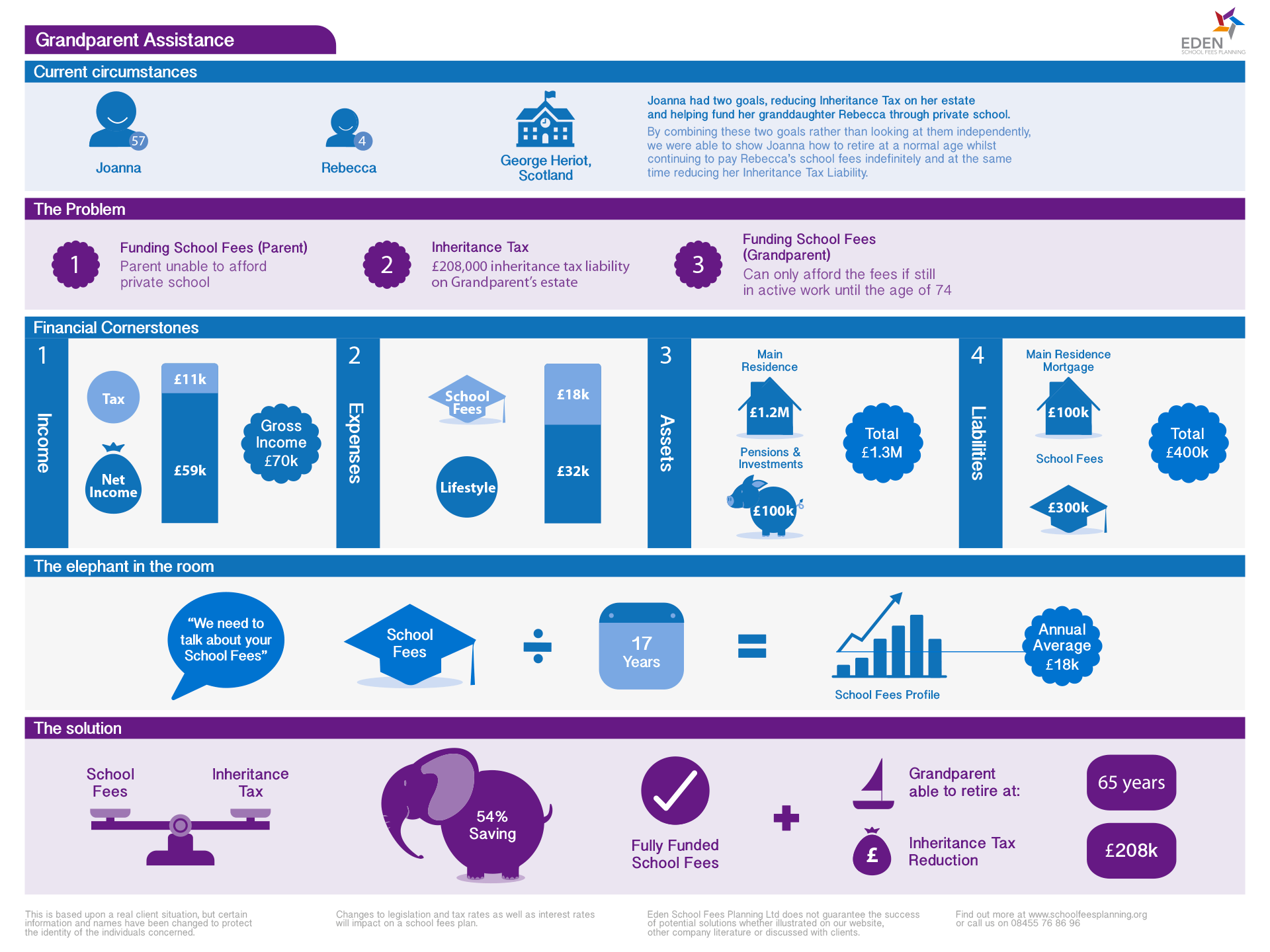

The Grandparent

Balancing your own financial needs with those of your family (children / grandchildren) can cause conflict and anxiety.

Joanna was in a comfortable financial position but had a major dilemma, retire early or help her daughter pay school fees, putting off her retirement for a number of years.

Why plan for School Fees

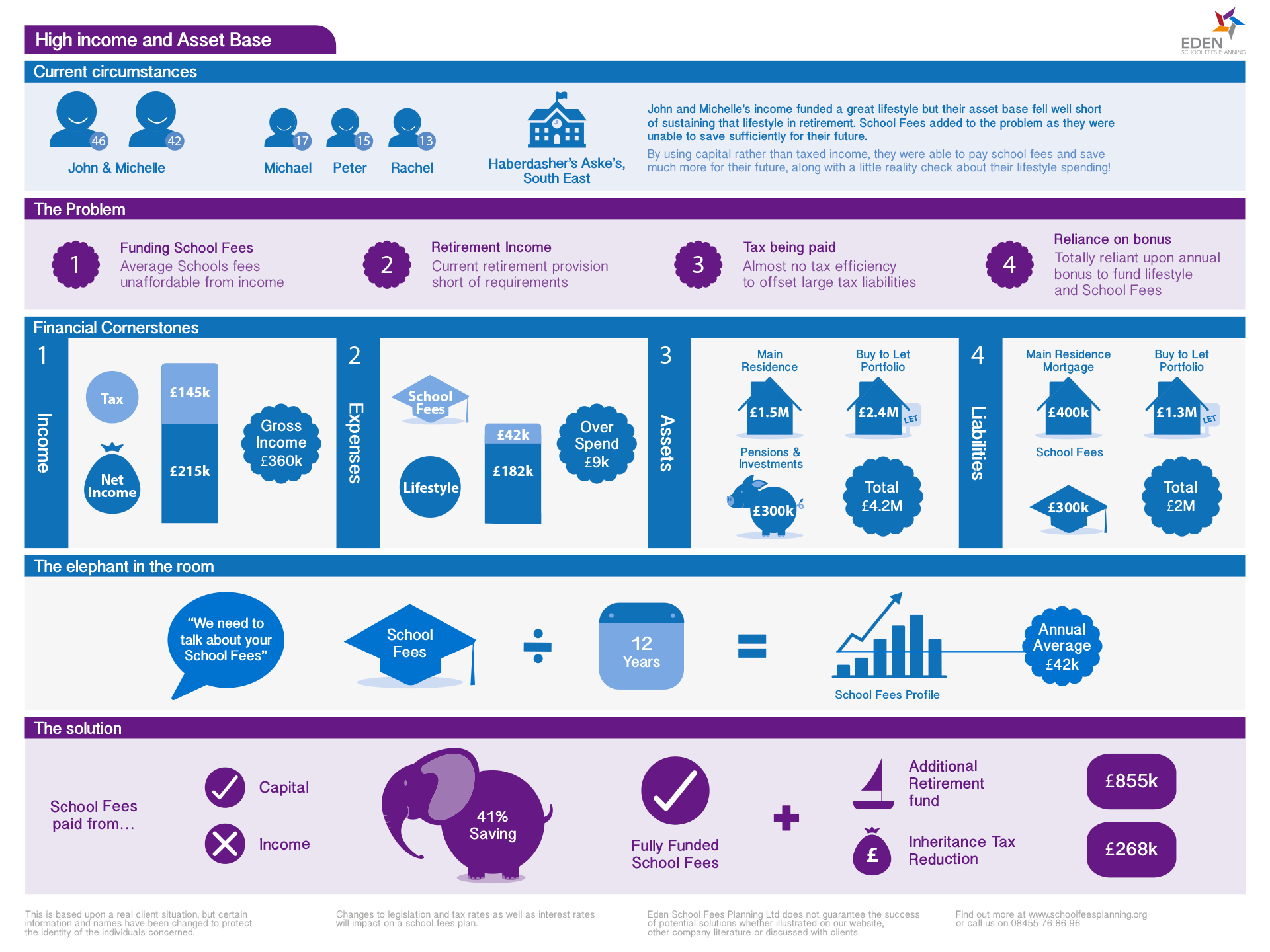

The cost of private school (age 4-18) is now over £300,000 per child, with most parents paying an additional £200,000 in income tax.

A School Fees Plan will show you how to fund your school fees efficiently, without neglecting your other long term financial goals.

There are often many alternative ways to fund school fees which can also facilitate your other financial goals. Improving your tax efficiency for example, will have a major impact on your long term wealth.

Whether you consider yourself in a good financial position or not, we believe every parent can benefit from a school fees plan.

THE EDEN DIFFERENCE

By focusing exclusively on School Fees we've built a wealth of expertise on solutions optimal for almost every client situation.

As you might imagine, we help families make the most of their financial resources, to minimise the significant impact of funding Private School.

We believe in the value of a Private Education, and whilst sadly it is not accessible to all, we are in the privileged position of being able to help thousands of families make it just that little bit easier.

The goal therefore is clear, to fund school fees, the art is in understanding your financial life and showing you what is possible. We aim to do that, show you what is possible, as quickly and clearly as we can, jargon free.

Our school fees plans are bespoke, each one ensures your school fees are affordable, efficient and sustainable, often showing savings of many tens of thousands of pounds.

If we cannot add value to you we will let you know and it will cost you nothing to find out!

About us

30 years experience | millions of pounds in school fees saved

Gavin Crisp

Having attended Private School (many years ago) Gavin can personally attest to the benefits of Private Education.

"Saving money is what attracts parents to School Fees Planning but for me, the best thing is hearing from parents about the peace of mind they get in knowing their children's education is secure. That's what motivates me."

Robin Baker

With over 17 years financial services experience, Robin is one of the UK's most experienced school fees planners.

"There's great fulfilment in helping parents achieve their goals. Private Schools reduce the burden on the state system so I'm 100% behind helping parents reduce the cost wherever possible."