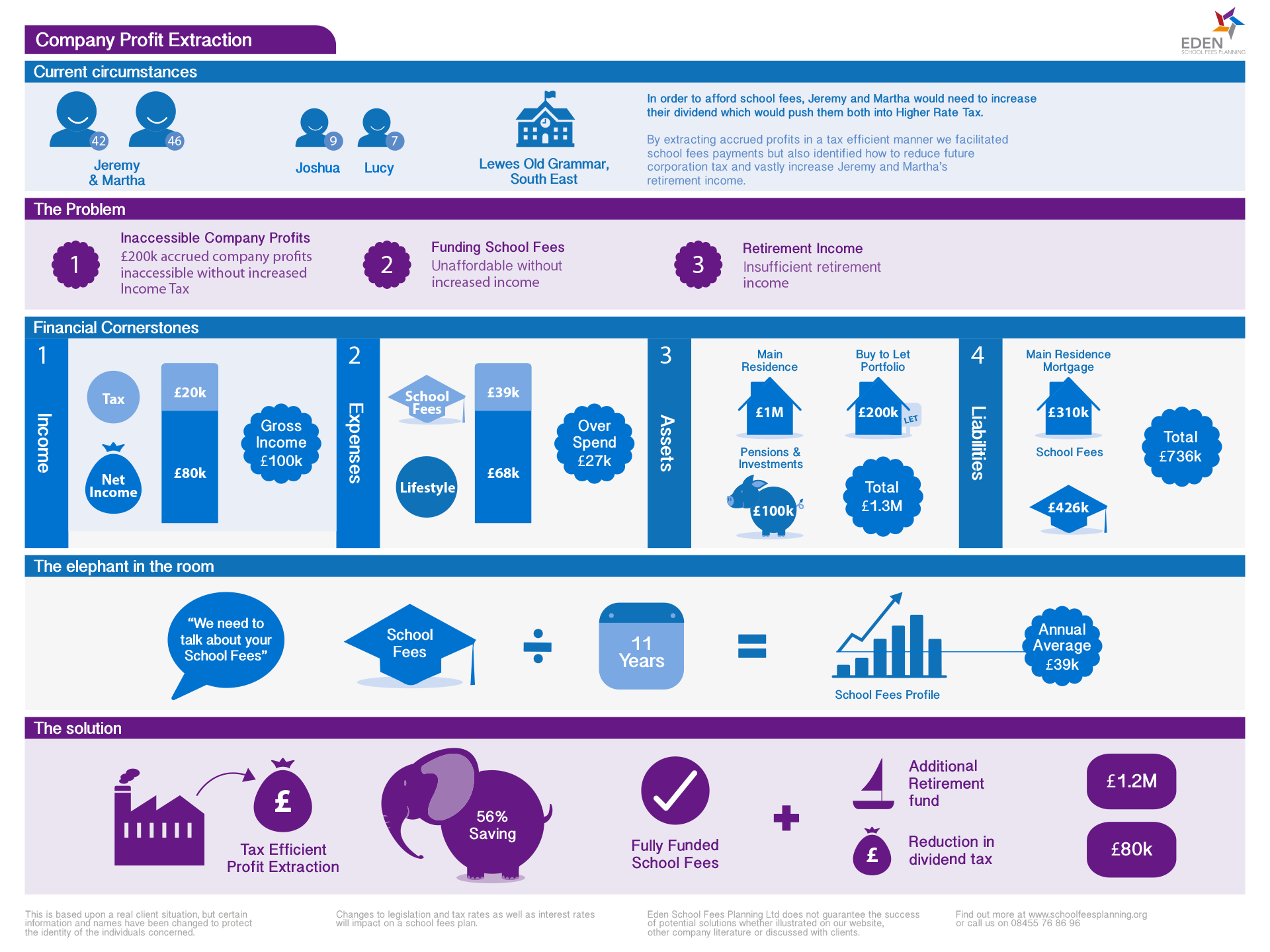

How we helped Jeremy and Martha

Financial Cornerstones

Basic Assessment

Jeremy and Martha had a successful business. They were able to afford private school however they were keen to avoid or at least minimise any exposure to higher rate tax.

The result was a sizeable cash holding in the business and no idea how to extract it. They came to us to see if there was a way to reduce the cost of their school fees.

A nice problem to have? Yes of course! It became clear Jeremy and Martha were not utilising all the available tax allowances which could help extract company profit without incurring a higher tax bill.

Problem and Implications

Jeremy and Martha’s business had become successful, opening the door to private school however leaving them with some issues:

Jeremy and Martha’s lifestyle was stifled by an unwillingness to pay higher rate tax.

They had several requirements of which many were on hold through a false sense of financial restriction.

They were concerned about their lack of protection. The business was young and growing but totally reliant on them as they were on it to fund their lifestyles and children’s education.

They realised that although the company had £200,000 in reserves, they themselves had very little. Neither they nor the company was contributing to a pension.

It is not sensible to allow money to build up in a business without a clear business reason for doing so.

They were also highly likely to leave a sizeable estate and IHT problem for their children however they were happy to leave that concern for a later time.

The Great Profit Extraction!

Jeremy and Martha’s real issue was one of mindset. They were allowing the avoidance of tax (by restricting their income) to impede their lifestyle.

Our focus was on helping with their school fees and keeping things as tax efficient as possible. To do this there were several elements which came together. The change of mindset, was all down to them.

School Fees Mortgage

With no personal savings or sufficient income to cover school fees, the only asset from which Jeremy and Martha could draw was the equity in home.

We discussed utilising a “School Fees Mortgage” which would gain them two important advantages:

Protection

Starting an insurance policy, paid for by the company would help reduce corporation tax.

We helped Jeremy and Martha understand how to best use the different types of insurance, and the possible cost of cover.

Pension

Jeremy and Martha felt they were lacking in pension provision. Although they had a company with surplus profits they did not realise the company could contribute to a pension on their behalf.

We helped them establish retirement lifestyle goals and then working backwards, calculated the funding needed to build their nest egg.

We made them aware that they could also use their pension assets, accessible from age 55 to help repay their mortgage

Other Investments

Investments such as EIS and VCTs can also provide tax benefits on contributions in a similar way to pensions.

Jeremey and Martha were keen to explore all avenues of tax mitigation so we discussed how the use of EIS for example could also assist in extracting profit from their business in a tax efficient manner.

Benefits

We gave Jeremy and Martha time to explore their options. We reduced the income focused burden of school fees payments meaning they could apply the necessary attention to company profit extraction. This resulted in a much better use of their company status for personal planning purposes which subsequently improved their ability to pay school fees.